Retirement

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Preparation is the Key to Retirement

The simplest ideas can sometimes make a massive difference over time. Enjoy this brief video to learn more.

Have A Question About This Topic?

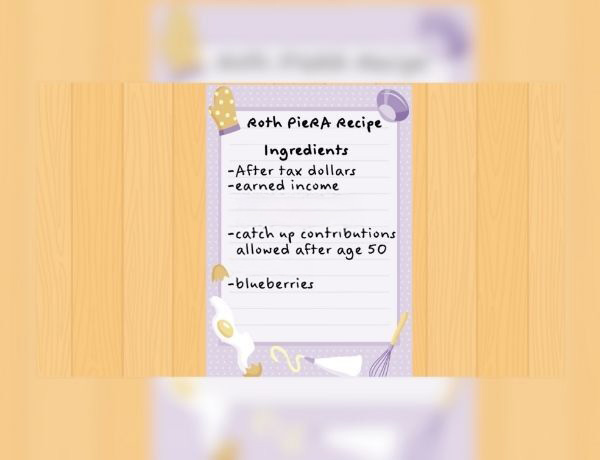

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Saving Early & Letting Time Work For You

The earlier you start pursuing financial goals, the better your outcome may be.

Dreaming Up an Active Retirement

When you retire, how will you treat your next chapter?

Financial Strategies for Women

Some may leave their future to chance but in the world of finance, the effects of the "confidence gap" can be apparent.

9 Facts About Retirement

Regardless of how you approach retirement, there are some things about it that might surprise you.

Does Your Portfolio Fit Your Retirement Lifestyle?

Lifestyle considerations in creating your retirement portfolio.

Immediate vs. Deferred Annuities

Looking forward to retirement? It's critical to understand the difference between immediate and deferred annuities.

Why Medicare Should Be Part of Your Retirement Strategy

How Medicare can address health care needs in your retirement strategy.

What's New for Social Security?

There have been a number of changes to Social Security that may affect you, especially if you are nearing retirement.

View all articles

Potential Income from an IRA

Estimate your monthly and annual income from various IRA types.

My Retirement Savings

Estimate how long your retirement savings may last using various monthly cash flow rates.

Saving for Retirement

This calculator can help you estimate how much you may need to save for retirement.

Self-Employed Retirement Plans

Estimate the maximum contribution amount for a Self-Employed 401(k), SIMPLE IRA, or SEP.

Estimate Your RMD

Help determine the required minimum distribution from an IRA or other qualified retirement plan.

A Look at Systematic Withdrawals

This calculator may help you estimate how long funds may last given regular withdrawals.

View all calculators

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

Encore Careers: Push Your Boundaries

Ready for retirement? Find out why many are considering encore careers and push your boundaries into something more, here.

How to Retire Early

Retiring early sounds like a dream come true, but it’s important to take a look at the cold, hard facts.

Should You Tap Retirement Savings to Fund College?

There are three things to consider before dipping into retirement savings to pay for college.

A Bucket Plan to Go with Your Bucket List

A bucket plan can help you be better prepared for a comfortable retirement.

Retirement Accounts When You Change Your Job

This video discusses issues related to your retirement accounts when you move on from your job.

View all videos

-

Articles

-

Calculators

-

Videos